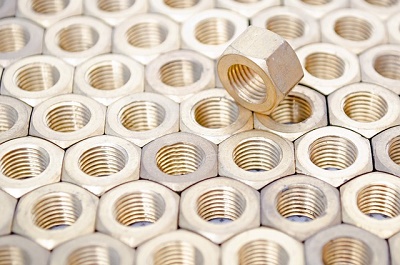

Castle Square advised on the Management Buy-In/Buy-Out of Midlands based Alca Fasteners Limited, a manufacturer and exporter of large diameter high integrity bolting. The deal was financed through an innovative debt funding package arranged by SME Capital and provided by Hadrians Wall Capital. Legal advice was provided by Peter Crawford and team from Freeths.

Following completion of the transaction, Jon Neate becomes Managing Director and shareholder in the company alongside the existing management team. Jon states “ALCA’s reputation is based on high quality products, specialist specifications and renowned reliability and service delivery. This has been developed through long-term trading with most of its larger customers that operate in the European Energy sector. Myself and the Management team are looking to continue to develop the Alca brand and are targeting significant new opportunities in new markets.”

Management was advised on the transaction by Steve Bell, Director of Castle Square Corporate Finance, a leading independent advisory firm. Steve Bell, said “This was a complex deal both in terms of negotiation and structuring. The Management Buy-In element added additional complexities, with these kinds of deals being the most difficult to obtain funding for in the current market place. We appreciate the support from Antoine Grisay and the team at SME Capital who managed the debt process on behalf of Hadrians Wall Capital with the facility representing the first investment from the fund.”

Jon Neate said, “Having been introduced to the opportunity by Steve Bell, Castle Square provided the support throughout the transaction, identifying appropriate funders and leading negotiations with SME and Hadrians Wall to deliver the deal”.